Maximum borrowing mortgage

How long would you like your mortgage for. Maximum Borrowing Calculator.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

When arranging mortgages we need to.

. Second time buyers can take out a mortgage of up to 80. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteria. In some cases we could find lenders willing to go up to 5 times.

Think of it as a maximum. For example if you are buying a house worth 200000 and your deposit is. An estimate of the maximum mortgage amount that NerdWallet recommends A ballpark of your monthly mortgage payment The maximum amount a lender might qualify you for And how.

Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross income. Applications for additional borrowing are subject to the loan to value and must meet our current lending requirements which include being resident in the UK. Please select 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20.

But to give you a rough answer in the simplest form lenders will allow you to borrow up to around 449 to 5 times your income. Borrowing 5000 at an interest rate of 3 taken over 20 years would cost you 163088 in interest payments thats just on the extra borrowing Yet borrowing 5000 at an. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

Find out how much you can borrow using our mortgage borrowing calculator simply by answering a few questions. Minimum amount is 10000. The percentage size of your.

To work out your LTV enter a property value and deposit amount. This calculator estimates how much you may be able to borrow and if such borrowing is generally considered affordable if interest rates rise. We calculate this based on a simple income multiple but in reality its much more.

A personal loan could be an option if you need less 03 Minimum term 3 years - maximum term 35 years maximum age 70 04 Additional borrowing is available. This is called your borrowing power. For this reason our calculator uses your.

Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. 4 or 45 times salary was the limit. Maximum Loan Calculator This calculator helps you work out the most you could borrow from the bank to buy your new home.

Simple maximum mortgage calculator Enter your total household income Enter your total monthly payments for all credit commitments that will run for more than 6 months after the end of the. A typical maximum LTI ratio is 45 times which means if your total joint income was 60000 you could in theory borrow a maximum of 270000 for a mortgage. If you want a more accurate quote use our affordability calculator.

First time buyers can take out a mortgage of up to 90 of the purchase price of a home. Shows the cost per month and the total cost over the life of the mortgage including fees interest. Other FAQs What is Loan to value.

Mortgage lenders used to calculate how much they would lend by a simple rule-of-thumb multiplication of an applicants income. To work out the maximum you could borrow enter your income and the income of any joint applicant. This is a percentage that shows the split between your mortgage and the loan amount after youve paid your deposit.

2022 Jumbo Loan Limits Ally

Determine A Max Home Loan Given A Monthly Payment Formula Youtube

Guide To Reverse Mortgage Statements Heritage Reverse Mortgage

Fha Jumbo Loans In 2022

Suzanne Greene Mortgage Originator Remember My Announcement Yesterday About The Conforming Loan Limits Increasing Well I Have Better News For 2022 Fha Loan Limits Have Increased If You Ve Wanted To Pursue Your

Fha Loan What To Know Nerdwallet

What Is The Maximum Student Loan Amount For A Lifetime Sofi

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Student Loan Limits How Much Can You Borrow Penfed Credit Union

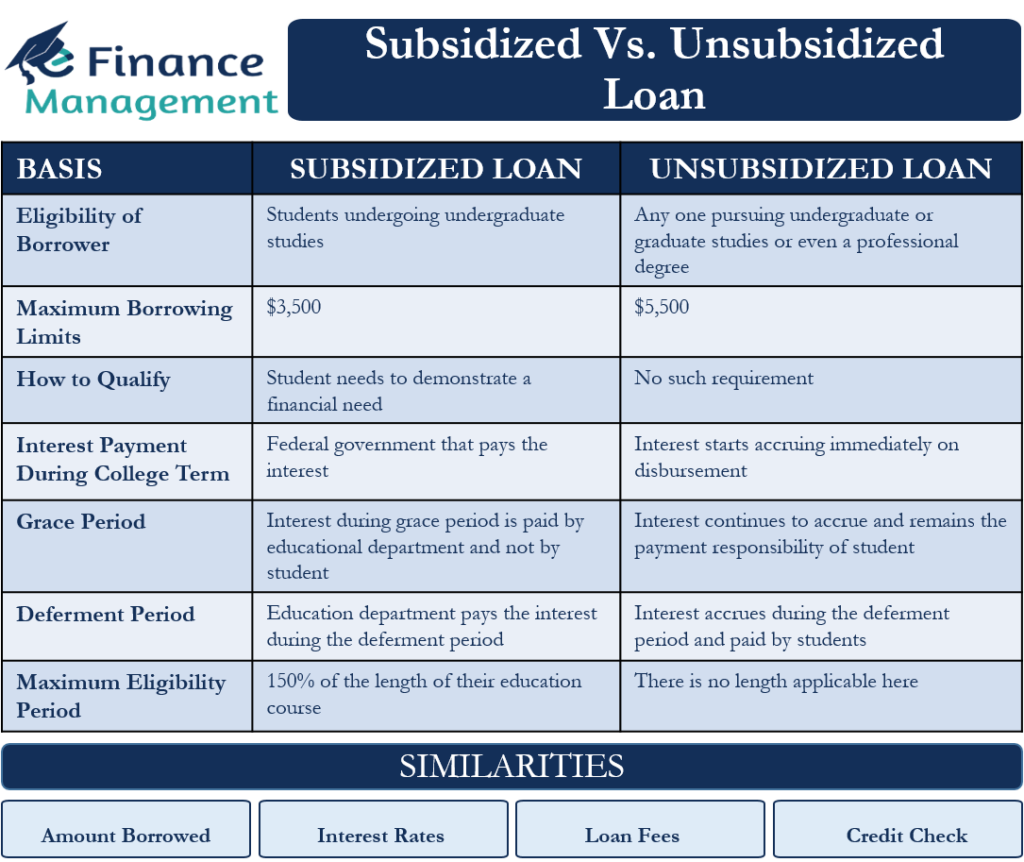

Subsidized Vs Unsubsidized Loan Differences And Similarities Efm

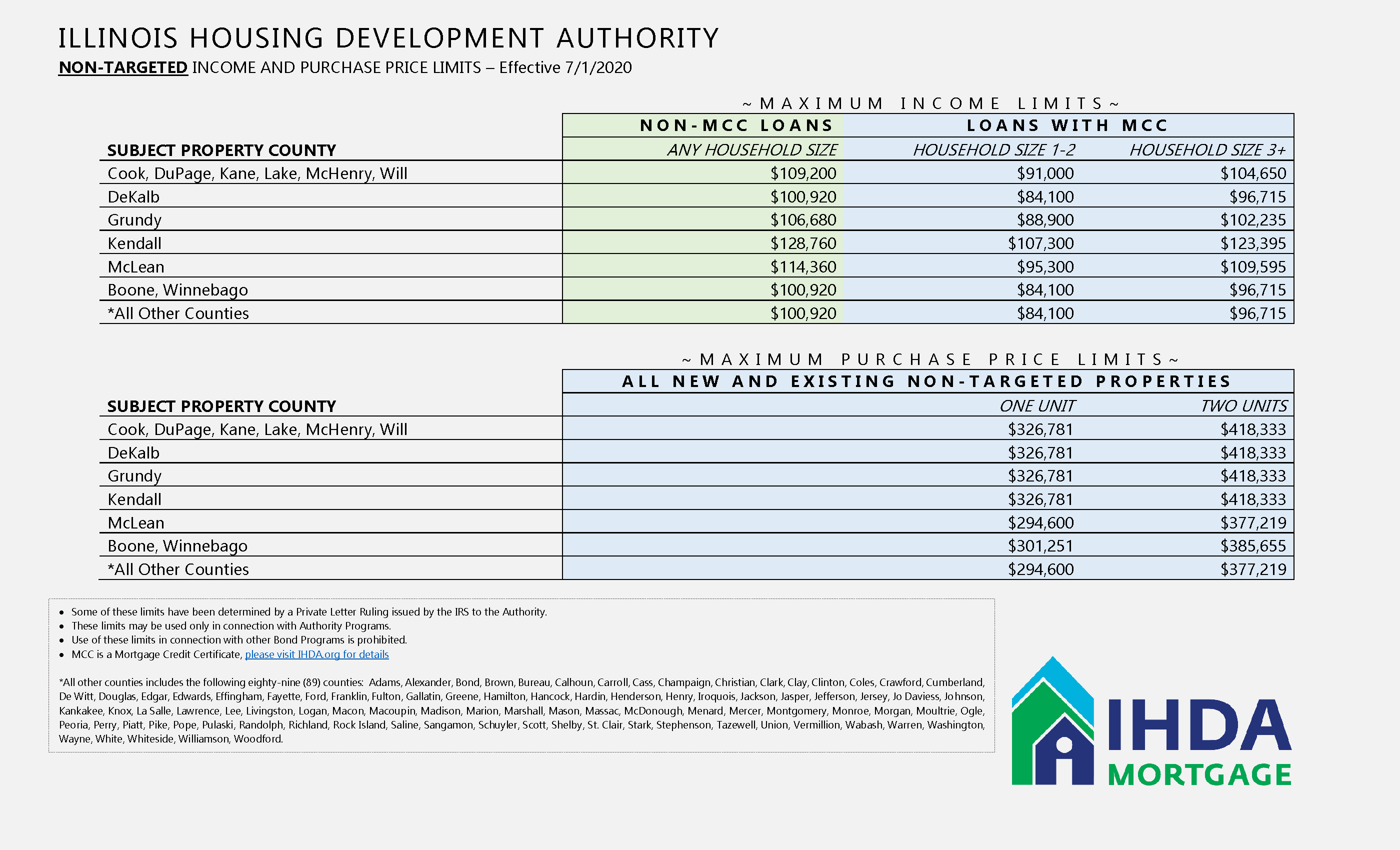

Income And Purchase Price Limits Ihda

New 2022 Conventional Loan Limit Increase Gmfs Mortgage

Va Loan Limits For High Cost Counties Updated For 2021 Military Com

2022 Orange County Conforming Loan Limits Enjoy Oc

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

How Much Can I Borrow Home Loan Calculator